But how do you KNOW this? Don’t you think this is something you should know before agreeing to “indemnify” someone against “any and all claims” of “whatever cause whatsoever”? You are assuming many things. But in contracts, you cannot assume because a court will read the “four corners of the contract” and enforce it as written absent an ambiguity. What would that say about a horse show sponsor if you asked them if they were insured and they refused to answer? I’m not sure people would actually be willing to suffer serious injury by throwing themselves in front of a runaway horse just because they knew they could file an insurance claim. What kind of people do you hang out with??

My conclusions are based on contract law according to my husband, a lawyer who is a plaintiff’s lawyer doing personal injury, employment law, and business law (including for an equine business entity and horse owners). Let’s take Kentucky as an example since that is where the show in question takes place. Under Kentucky law, according to DH, “Absent an ambiguity in the contract, the parties’ intentions must be discerned from the four corners of the instrument without resort to extrinsic evidence.” Wagner v. Wagner, 563 S.W.3d 99 (Ky.App. 2018). Assume, for the moment, that the one in a billion chance that the show demands you indemnify them for damages resulting from an occurrence you had nothing to do with. You certainly could argue in your defense a) I didn’t really read the contract; b) I assumed they were insured; c) I didn’t mean what it says; d) I was drunk when I signed it, e) I am unsophisticated in contracts while the show had a team of lawyers behind them; f) any terms of a contract should be construed against the party who drafted it, etc. etc. Assuming, further, that you somehow prevail on one or more of these defenses. You still had to spend a lot of money on lawyers and deposition costs. How do you eliminate the one in a billion chance? a) Refuse to sign such a broad agreement and demand that it be changed; b) if they refuse to change the language, don’t show there; c) cover the one in a billion chance with your own insurance; or d) take the chance and roll the dice. Surely, if everyone refused to sign such an all-inclusive, unlimited indemnity agreement, the show would change it. But they know most people don’t read it or don’t understand it. So why change it?

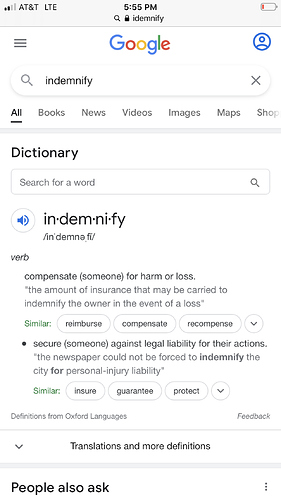

Where are you getting all these assumptions? Who else is sued IN ADDITION to you is besides the point. Again, I am not saying that this hypothetical outcome is likely. I am fully conceding that it is very unlikely or, 1 in a billion, as you say. But that is not the question. The question is, did you know you were agreeing to this 1 in a billion chance when you signed the indemnity clause that was all-inclusive and unlimited? Did you read it? Did you know what “indemnify” meant when you read and signed it? If the answer to all these is yes and you were still willing to roll the dice for the chance of showing, then fine. At least you did it knowingly. But I am perplexed at how many do not read these agreements, do not know what they are agreeing to, and do not at least protest to show management for a change to the language. As I’ve said, not all horse shows have such all-inclusive language. So if enough people complained, they would change it and the 1 in a billion chance becomes zero.

I’m not saying it’s only me. In fact, my hypothetical would likely involve the show mailing a demand letter to everyone who agreed to indemnify them. Yes, parents, in a survivorship action, DO get to presume occupation of their deceased 1st grader. How do you think juries arrive at $30 million medical malpractice verdicts in cases of wrongful death caused by medical negligence? They get an economist expert to testify that, both parents are Harvard educated brain surgeons so it is very likely that the child would also get into Harvard and become a surgeon who would have made millions of dollars over his/her lifetime. That is how our courts allow the valuation of a lost life whether you agree with the method or not. But even a clerk at Wal-Mart will make hundreds of thousands of dollars over their lifetime and that would be the value of their lost life (not even counting losses claimed by the parents for the loss of their child’s love). Again, this may be a 1 in a billion outcome – I get that. But did you KNOW you were agreeing to this? Why not complain to the show and say you do not want to agree to even the 1 in a billion chance if you had nothing to do with it.

We as riders should know what we’re signing. Maybe this post will help one person to rethink signing a release before knowing what they are signing.

We as riders should know what we’re signing. Maybe this post will help one person to rethink signing a release before knowing what they are signing.