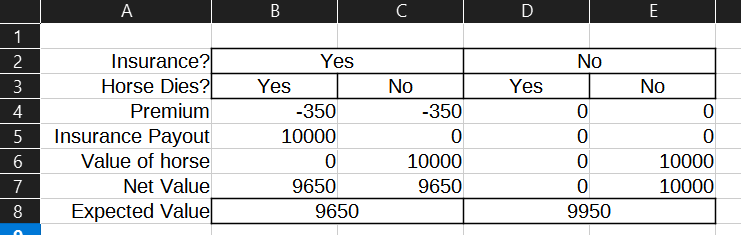

I recently got an online quote from Markel for mortality insurance at 3.5% of the insured value. That seemed like a lot, so I asked Chat GPT to help me figure out the Expected Value for having insurance vs not having insurance. Kind of trying to figure out the cost of taking the risk vs paying the premiums, if you could run the experiment a million times. Does anyone want to take an edible and come along?

So it turns out, and this was not intuitive to me as a non-math person but maybe to others it is obvious, the EV for no insurance and the EV for insurance cross when mortality is .5% of the premium rate. From ChatGPT:

Net Benefit of Insurance vs. No Insurance

Scenario: $10,000 horse value, 3.5% premium rate

Equations:

-

EV with insurance:

EV_ins = (10,000 × p) - 350 -

EV without insurance:

EV_no_ins = -10,000 × p -

Net Benefit:

Net Benefit = EV_ins - EV_no_ins = 20,000 × p - 350

This shows how much better or worse insurance is compared to going uninsured, based on the mortality probability ( p in decimal form).

Key Insight:

- Net Benefit is zero when

p = 0.0175(1.75%) - Below 1.75% , insurance has negative net benefit (you’re losing expected value)

- Above 1.75% , insurance has positive net benefit

I’m back. So with a mortality rate of .5x the premium rate, the EV of owning the horse is still negative (lol) but it’s better to have insurance than to not have it. But of course, why would an insurance company sell you that policy? They probably wouldn’t, right? So what should I assume as the expected mortality rate?

The USDA did a study in 2015 that included this table. (side note: RIP federal government and these useful things)

Table 2. Percentage of resident equids that died or

were euthanized in the last 12 months, by age at

death

<6 months: 2.8%

6 months to less than 1 year: 1.2%

1 year to less than 5 years: 0.5%

5 years to less than 20 years: 0.8%

20 years or older: 3.1%

If I plug in a mortality rate of .5% for my hypothetical $10k horse with a $350 premium, the net EV (the difference between the EV of having insurance and the EV of not having it) is -$250. At a mortality rate of .8%, it’s -$190. I thought this was a really interesting way to think about the cost of not risking the loss vs risking it. I know for a lot of people mortality insurance is just the path to medical coverage, so maybe this isn’t useful to them. But just in case someone is interested, here it is!